The BLUF: Russia’s ability to weather Western sanctions is linked to more than a decade of efforts designed to insulate Russia’s economy from Western economic measures. These actions include amassing gold, divesting US dollars, seeking alternatives to Western-controlled financial institutions, and partnering with non-West-aligned nations that enable sanctions avoidance. As the West levies additional sanctions against Russia, the Kremlin is exploiting the economic actions to promote international “de-dollarization” and the establishment of international financial institutions that are less susceptible to Western influence and immune from sanctions, activities Moscow believes will likely undermine US economic prowess.

Are you busy with other things or are you a multitasker? Let me read this report to you!

Russia’s ability to weather Western sanctions is very likely due to several factors; 1) efforts to insulate the Russian economy, 2) partnering with nations that enable sanctions avoidance, and 3) Western nations’ economic dependence on Russia. Collectively, these factors have enabled Russia to confound Western economic efforts to damage Russia’s economy and undermine the Kremlin’s ability to execute war in Ukraine.

Insulating the Russian Economy

For nearly 20 years, Russia has managed its economy while facing Western economic sanctions.1 2 3 Since the early 2000s, the Kremlin has attempted to shape the Russian economy in a manner that reduced its dependency on Western nation goods, the United States dollar, and Western economic institutions — due to Moscow’s perception that Western nations use international commerce as an extension of Western soft power measures. Specifically, for more than a decade, Russian President Vladimir Putin has claimed the US weaponizes the dollar, Western economic institutions (e.g. Society for Worldwide Interbank Financial Telecommunications (SWIFT)), and reliance on Western nation imports (such as technology) as means to control nations that do not comply with Washington’s foreign policy desires.4 5 6 7 8

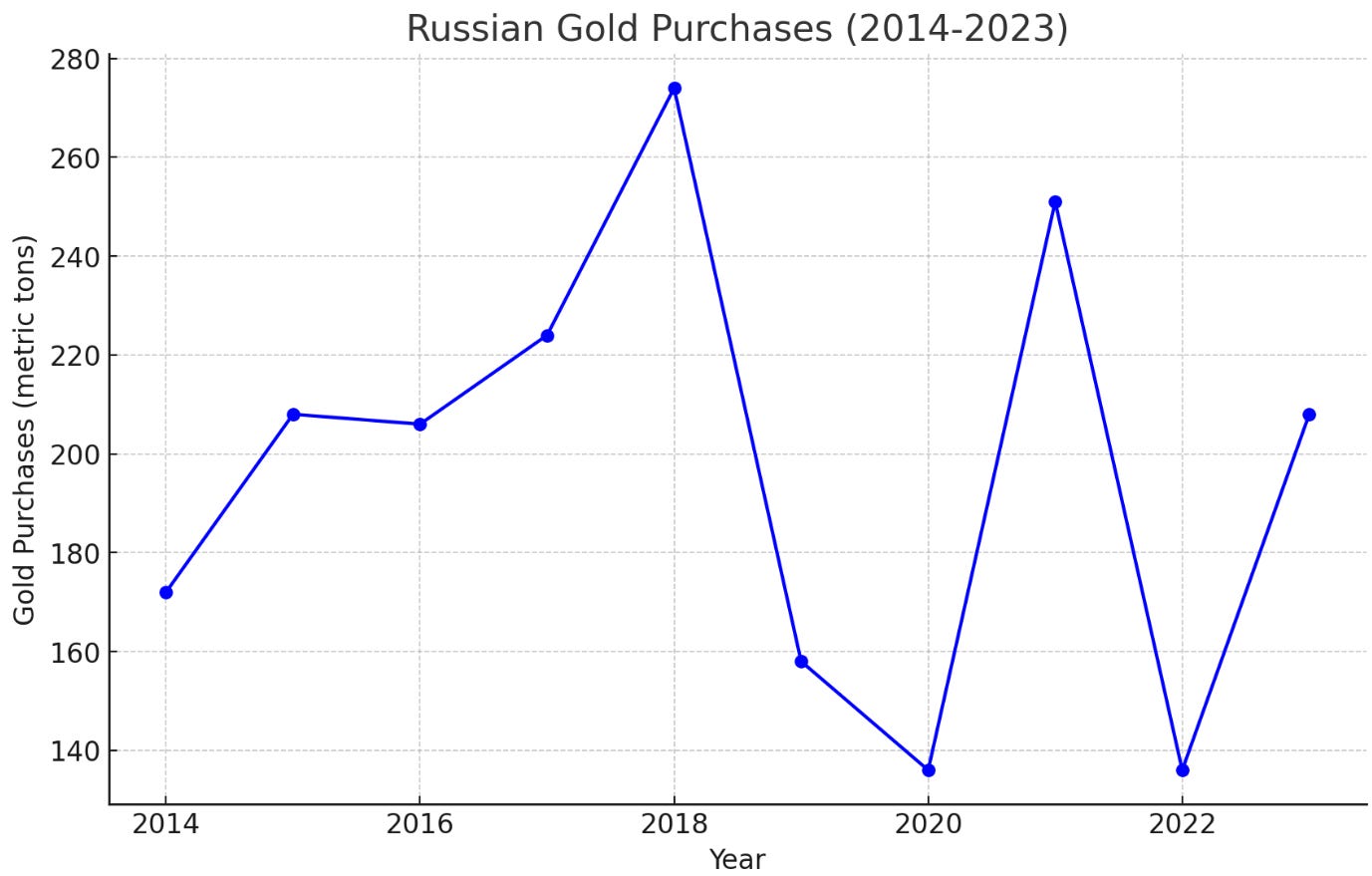

Over the past several years, the Kremlin has enacted policies designed to protect the Russian economy against what Moscow perceives are Western punitive economic measures. These actions include; investing in and amassing physical gold as a store of wealth, investing in the domestic production of critical goods, increasing trade with nations less likely to consent to Western economic pressure, and reducing its reliance or use of US dollars in international financial transactions.9 10 11 12 13 14 15 16 17 18 19

Partnering with Non-West-Aligned Nations

During the 2000s, especially after the West levied sanctions against Russia after its war with Georgia in 2008, the Kremlin determined that it must expand its strategic cooperation with nations that Moscow believed were not beholden to US influence. Over the past 15 years, the Kremlin has emphasized economic cooperation with nations in Africa, Asia, and South America. In part, Moscow targeted these regions because they have been subjected to Western covert operations, such as regime change, color revolutions, or other destabilization operations, which the Kremlin likely believes makes those regions more willing partners.

In the past five years, Moscow has prioritized economic cooperation with Beijing, which is now considered Russia’s most important strategic partner. Additionally, Russia has also increased its cooperation with other nations the West categorizes as adversaries, such as Iran and North Korea. These nations, in various ways, have aided Russia in circumventing Western sanctions — dampening the effects on Russia’s economy. Thus, Moscow has been able to continue importing and exporting goods the West has sanctioned, in some instances working through subsidiaries or cutouts abroad.20 21 22 23 24 25

Exploiting Western Nations‘ Dependence on Russian Goods

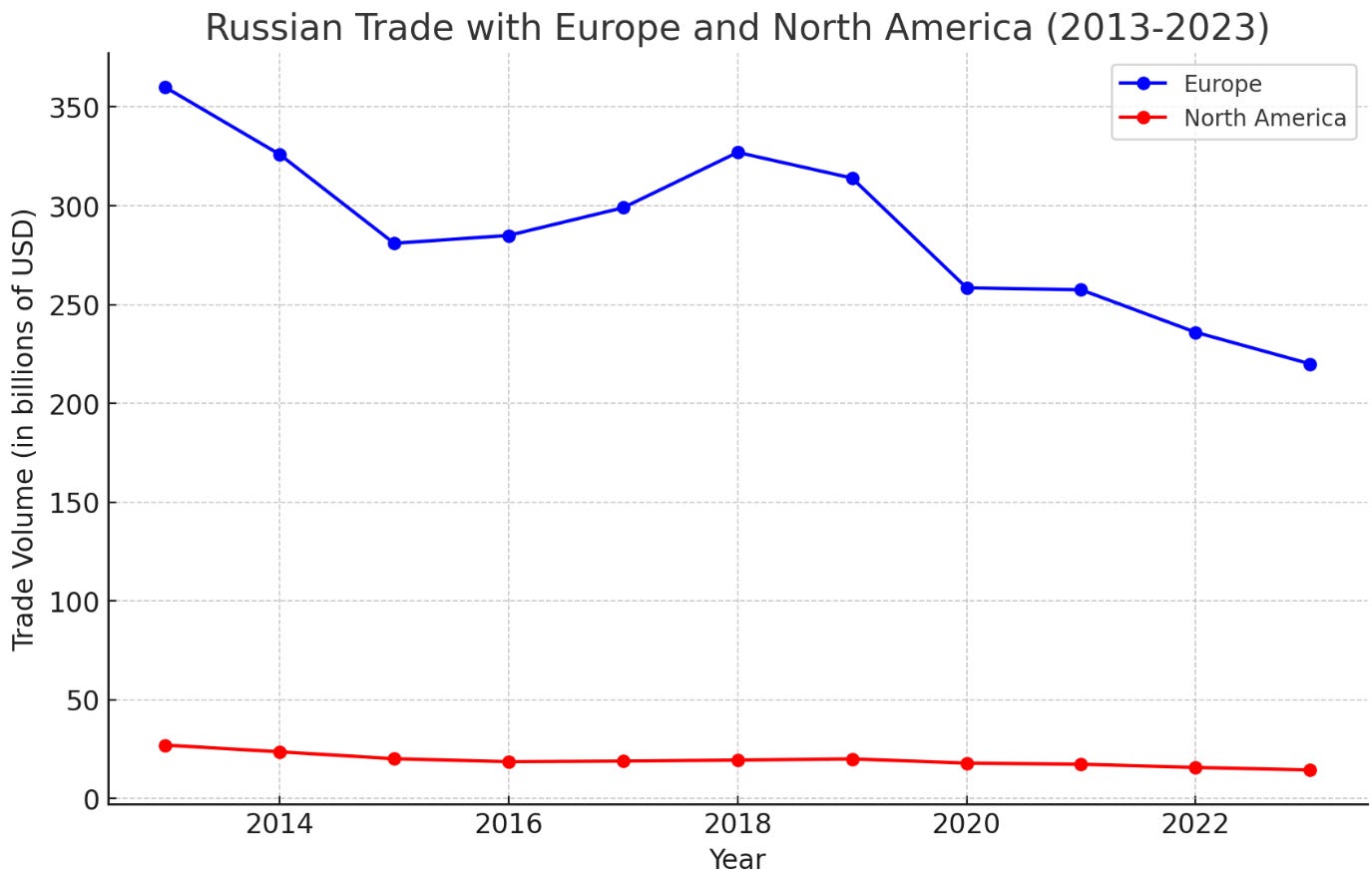

For nearly 20 years, Moscow has espoused a phrase that is designed to remind and warn Europe of the implications of negative relations with Russia; “Europe gets cold in the winter”. Given Russia and European economic integration, Europe has long been able to obtain resources from Russia at a low cost, especially Russian natural resources such as natural gas and oil. As part of the admitted intent of the post-World War 2 era, economic interdependency was assessed to make the potential of large-scale war less likely given the impact it would have on international commerce — colloquially called “globalism”.

Despite Western nation rhetoric concerning efforts to employ sanctions intended to strategically damage Russia’s economy, Western nations and Western corporations continue to engage with Moscow — including those nations and companies that initially discontinued commerce with Russia. For European nations, Russia has been able to leverage its economic influence and interdependency to counter the impact of sanctions. For example, although a central European nation levies sanctions against Russian grain exports, they continue to import Russian liquid natural gas. For corporations, the Kremlin was able to leverage the potential corporate losses associated with the inability to operate in Russia’s economic market as an incentive for corporations to prioritize corporate profits over aligning with geopolitical sentiment.26 27 28 29

Collectively, these practices have enabled Russia’s economy to thrive amidst ongoing Western economic sanctions. According to Western economic data, Russia’s economy has largely avoided the strategic damage Western nations sought to inflict via targeted sanctions. On June 11, 2024, the World Bank revised its economic forecast for Russia, projecting a higher gross domestic product growth projection for 2024.30 In early 2024, data from the International Monetary Fund ranked Russia as the strongest national economy in Europe, surpassing Germany in terms of purchasing power parity.31

Strategic Outlook and Implication

Russia will very likely continue to exploit Western economic measures to encourage nations to reduce their dependence on Western economic instruments and seek alternatives that are less susceptible to Western government influence. Since the West instituted more aggressive economic sanctions against Russia in February and March 2022, the Kremlin has increasingly promoted its economic model to nations in Africa, Asia, and South America. Specifically, Moscow is exploiting concerns that the West, led by the US, could levy strategic sanctions against other nations if they don’t comply with Washington’s foreign policy.

For nearly a decade Russia has called for the creation of an international financial structure that is less vulnerable to US influence. Since 2022, Moscow’s recommendations now include nations reducing their use of the US dollar and Western financial institutions, engaging in international financial transactions in “native currencies”, and establishing alternatives to SWIFT. Over the past year, Russia has used its position in the Brazil, Russia, India, China, and South Africa (BRICS) economic bloc to support its proposals, which is likely responsible for an increase in nations seeking BRICS membership since 2022. These actions, Russia claims, will enable nations to protect themselves from the potential of US economic sanctions or asset seizure.32 33 34

The Kremlin views international “de-dollarization” as a strategic blow to the US. For the past 10 years, Putin and other Russian national leaders have claimed that the US manipulates international financial markets, specifically via “money printing”.35 36 37 Moreover, Moscow has suggested that if more nations “de-dollarize”, and divest themselves of US bonds and US debt, it would undermine the international financial market but — likely result in an economic collapse in America. Specifically, the Kremlin points to US national debt as unsustainable and believes that US economic stability hinges upon the US dollar’s world reserve currency status.38 39 40 Notably, in May, Russia’s representative to the IMF called for BRICS nations to “prepare for US dollar collapse” as nations increasingly reduce its use of the US dollar.41

https://tass.com/politics/1701459

https://tass.com/politics/1722415

https://tass.com/politics/1799109

https://tass.com/politics/1799143

https://www.rt.com/business/585713-musk-dollar-weaponization-russia/

https://www.rt.com/business/588065-us-weaponizing-dollar-lavrov/

https://tass.com/politics/1799201

https://tass.com/world/1778563

https://tass.com/economy/1798339

https://tass.com/economy/1681859

https://www.rt.com/business/576451-russia-gold-investment/

https://tass.com/politics/1780747

https://tass.com/economy/1717533

https://tass.com/economy/1749245

https://tass.com/economy/1799885

https://www.rt.com/business/587260-russia-trade-growth-asia-africa/

https://www.rt.com/africa/583886-russia-africa-trade-surge/

https://www.rt.com/business/599225-yuan-moscow-exchange-trading/

https://tass.com/politics/1744113

https://www.rt.com/business/586333-russia-asia-trade-growth/

https://tass.com/economy/1790685

https://www.rt.com/business/590386-russia-brazil-trade-soaring/

https://tass.com/economy/1707047

https://tass.com/economy/1801041

https://www.rt.com/africa/596274-africa-russia-imports-top-americas/

https://www.chathamhouse.org/2024/06/eus-continued-dependency-russian-gas-could-jeopardize-its-foreign-policy-goals

https://ecfr.eu/article/conscious-uncoupling-europeans-russian-gas-challenge-in-2023/

https://www.brookings.edu/articles/europes-messy-russian-gas-divorce/

https://www.marshallcenter.org/en/publications/occasional-papers/europes-dependence-russian-natural-gas-perspectives-and-recommendations-long-term-strategy-0

https://openknowledge.worldbank.org/server/api/core/bitstreams/aa9feaf4-0331-467d-9f46-10b9a1aef5a9/content

https://www.rt.com/business/596078-russia-economy-growth-upgrade-imf/

https://www.rt.com/business/565510-putin-independent-financial-system/

https://www.rt.com/business/598707-russia-china-swift-replacement/

https://www.rt.com/business/590267-russia-iran-ditch-swift/

https://tass.com/economy/1778867

https://www.rt.com/russia/537407-putin-cnbc-dollar-inflation/

https://www.rt.com/russia/556587-putin-inflation-us-eu/

https://www.rt.com/news/581435-trump-dollar-reserve-decline-debt/

https://tass.com/economy/1730565

https://tass.com/economy/1318239

https://www.rt.com/russia/597003-brics-dollar-allternative-currency/